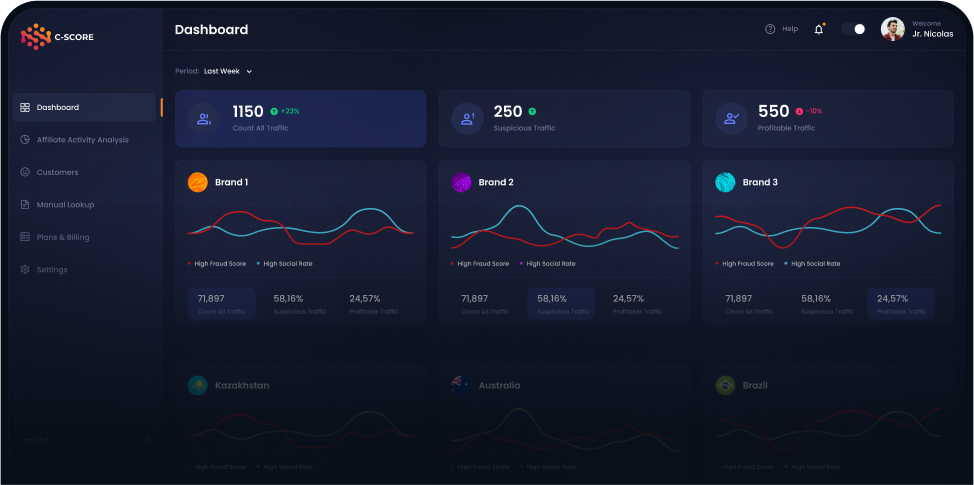

A powerful anti-fraud system to protect your business

Prevent fraud at every stage of the user journey. C-SCORE analyzes data, detects suspicious activity, and alerts you to fraud in real time

Fraud costs businesses billions annually

5 - 15%

revenue

is lost from transactionfraud, bonus abuse, andmulti-accounting

10 - 20% is

reduced

due to low-quality trafficfrom unethical affiliate partners

Primary Fraud Types Detected

Fraud schemes are growing increasingly sophisticated. C-SCORE deploys advanced technology to detect and prevent fraud

Affiliate Fraud

Fake registrations, conversion inflation, arbitrage traffic

Payment Fraud

Stolen cards, chargebacks, money laundering schemes

Multi-Accounting

Using multiple accounts for system manipulation

Bonus Abuse

Multi-accounts, bonus farming, fraudulent promo code redemption

Alternative option for KYC and AML verifications

The voluminous data set and user-friendly interface will allow analysts of any team to make the fastest and best decisions regarding each individual player, stream, affiliate partner by more than 2.5 times

How C-SCORE Works?

Registration Data Analysis

Scrutinizes emails, phone numbers, IPs, and fraudster devices during sign-up

- Detects disposable emails and virtual numbers

- Uncovers hidden connections between accounts

- Filters out anonymous registrations

Registration Data Analysis

Scrutinizes emails, phone numbers, IPs, and fraudster devices during sign-up

Activity Monitoring

The system tracks user behavior, payment activity, and platform interactions

- User data reliability verification

- Continuous background user verification

- Suspicious pattern detection

Activity Monitoring

The system tracks user behavior, payment activity, and platform interactions

Predictive Analytics

The system learns from real data to forecast fraud scenarios

- Automatic detection of emerging fraud schemes

- Background suspicious activity scoring

- Customizable trigger-response framework

Predictive Analytics

The system learns from real data to forecast fraud scenarios

Automatic Notification

When a foul is detected, the system notifies you of the anomaly, allowing you to decide whether to reject the transaction or request additional verification

- Actionable data to block suspicious users

- Customizable trust/risk thresholds

- Seamless KYC & AML system integration

Automatic Notification

When a foul is detected, the system notifies you of the anomaly, allowing you to decide whether to reject the transaction or request additional verification

C-Score uses advanced technologies

Registration Data Analysis

Scrutinizes emails, phone numbers, IPs, and fraudster devices during sign-up

Detects disposable emails and virtual numbers

Uncovers hidden connections between accounts

Filters out anonymous registrations

Activity Monitoring

The system tracks user behavior, payment activity, and platform interactions

User data reliability verification

Continuous background user verification

Suspicious pattern detection

Predictive Analytics

The system learns from real data to forecast fraud scenarios

Automatic detection of emerging fraud schemes

Background suspicious activity scoring

Customizable trigger-response framework

Automatic Notification

When a foul is detected, the system notifies you of the anomaly, allowing you to decide whether to reject the transaction or request additional verification

Actionable data to block suspicious users

Customizable trust/risk thresholds

Seamless KYC & AML system integration

C-SCORE detects a fraud in the background

How much you can save with C-SCORE

Try C-SCORE and protect your platform from multi-accounts

Fill out the feedback form and find out how your business can go beyond standard protection and achieve tangible growth