Secure payments with zero risk of losses

C-SCORE analyzes transactions in real time, detects suspicious activity, and prevents financial losses

C-SCORE analyzes their actions and prevents losses.

Financial losses from payment fraud are one of the most critical challenges for businesses

Use of stolen cards

Fraudsters make purchases using others' cards, and the rightful owner requests a chargeback

Chargeback Fraud

The customer requests a refund while keeping the product or winnings

Payout Fraud

Fraudulent balance inflation followed by illegal cash withdrawals

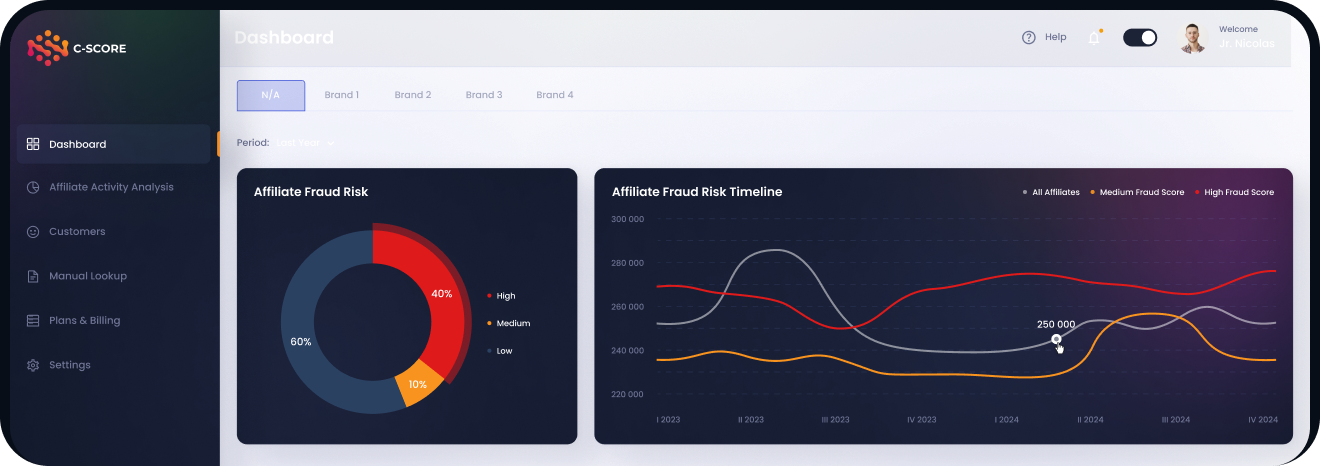

C-SCORE employs multi-layered payment analysis

Combining behavioral algorithms, machine learning, and transaction analytics

The system grows smarter with every transaction processed

Continuous learning & dynamic updates

Real-time fraud database updates

Detection improves with every case

Automatic integration of new fraud patterns

Continuous stolen card database refreshes

Stop fraud before it happens

01

Reduce chargeback and stolen card losses

02

Block fraudulent transactions without impacting legitimate customers

03

Minimize financial risks and reputational threats

04

Customizable rules and triggers tailored to your platform

Stop fraud before it happens

Secure payments without complex setup

Zero compromise on user experience or business operations

Results in Numbers

How much you can save with C-SCORE

Up to 70%

fraudulent transactions prevented

85%

in chargebacks

30%

false payment declines

Try C-SCORE and safeguard your business from payment fraud

Complete the contact form to discover how your business can move beyond standard fraud protection and achieve measurable growth

©C-SCORE TM, 2023-2025. All rights reserved.

Block 14 fl 1-2, Stimfalidon 52, 4046, Limassol, Cyprus

Back to Top ↑

designed by yuno.team